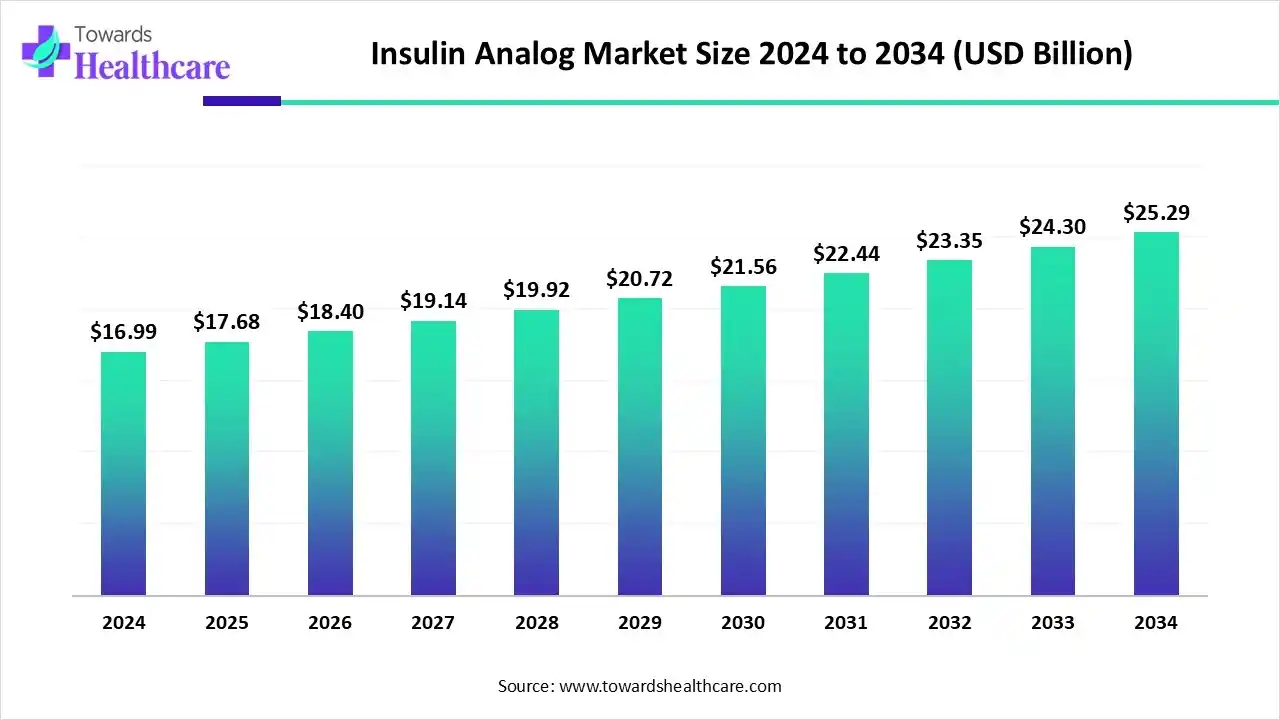

Insulin Analog Market Forecasting USD 25.29 Billion Valuation by 2034

The global insulin analog market size was valued at USD 16.99 billion in 2024 and is predicted to hit around USD 25.29 billion by 2034, rising at a 4.06% CAGR, a study published by Towards Healthcare a sister firm of Precedence Research.

Ottawa, Dec. 03, 2025 (GLOBE NEWSWIRE) -- The global insulin analog market size is calculated at USD 17.68 billion in 2025 and is expected to reach around USD 25.29 billion by 2034, growing at a CAGR of 4.06% for the forecasted period, driven by the increasing diabetes prevalence and growing innovations.

The Complete Study is Now Available for Immediate Access | Download the Sample Pages of this Report @ https://www.towardshealthcare.com/download-sample/6396

Key Takeaways

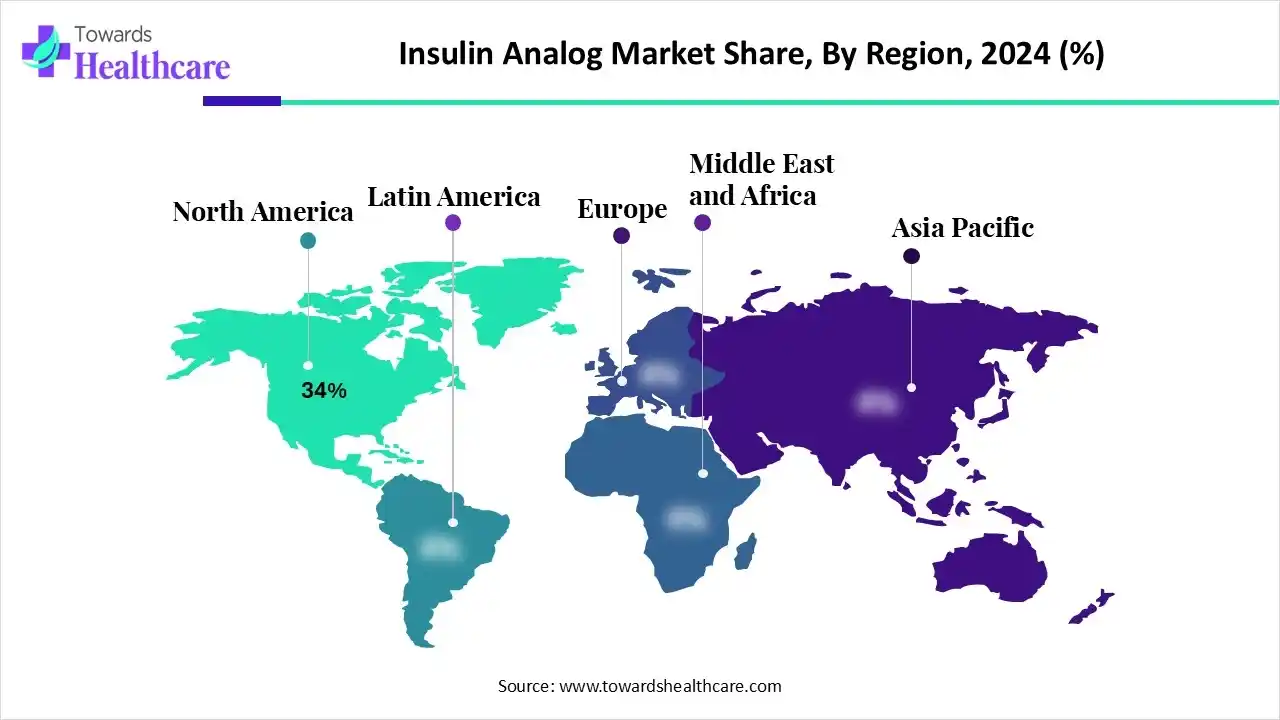

- North America held a major revenue of 34% share of the market in 2024.

- Asia Pacific is expected to witness the fastest growth in the insulin analog market during the forecast period.

- By molecule/action profile, the rapid-acting analogs segment held a major revenue of 30% share of the market in 2024.

- By molecule/action profile, the long-acting analogs segment is expected to witness the fastest growth in the market during the forecast period.

- By dosage form/presentation, the prefilled pens/pen cartridges segment held a major revenue of 45% share of the market in 2024.

- By dosage form/presentation, the vials (liquid) segment is expected to witness the fastest growth in the market during the forecast period.

- By therapeutic indication/patient type, the type 1 diabetes segment held a major revenue of 35% share of the market in 2024.

- By therapeutic indication/patient type, the type 2 diabetes segment is expected to witness the fastest growth in the market during the forecast period.

- By end-user/customer, the hospitals & clinics segment held a major revenue of 30% share of the market in 2024.

- By end-user/customer, the retail pharmacies/community pharmacies segment is expected to witness the fastest growth in the market during the forecast period.

- By technology/formulation innovation, the standard aqueous formulations segment held a major revenue of 55% share of the market in 2024.

- By technology/formulation innovation, the smart/connected delivery systems segment is expected to witness the fastest growth in the market during the forecast period.

What is the Insulin Analog?

The insulin analog market is driven by increasing diabetes incidences and technological advancements. The insulin analog is the laboratory-modified version of human insulin that helps in controlling the blood sugar level by providing faster, slower, or more stable insulin action than human insulin.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

What are the Major Growth Drivers in the Insulin Analog Market?

The increasing development of biosimilars is the major growth driver in the market. The growing diabetes cases is increasing the use of various biosimilars, which is driving their production, where they are also supported by the healthcare polices. Additionally, a growing geriatric population, smart insulin delivery devices, increasing awareness, and expanding access are other market drivers.

What are the Key Drifts in the Insulin Analog Market?

The market has been expanding due to the growing funding and collaborations to launch and enhance the use of various genotyping technologies.

- In July 2025, a total of ₹6.5 crore was secured in a Pre-Series A funding round by Lamark Biotech. To advance the development of InsulinStrong and scale up its proprietary ProteoStrong platform, this funding will be utilized.

- In March 2025, to expand access and affordability of Insulin Aspart in the U.S., a collaboration between Biocon Biologics and Civica, Inc. was announced. In this collaboration, the drug substance will be provided by Biocon Biologics to Civica, Inc. for the production of Insulin Aspart, a rapid-acting insulin analog.

What is the Significant Challenge in the Insulin Analog Market?

High cost acts as the major limitation in the market. The development of insulin analogs requires advanced technologies and complex manufacturing, which makes them expensive. Moreover, reimbursement limitations, storage challenges, competition from alternatives, and regulatory challenges are other market drivers.

Regional Analysis

Become a valued research partner with us - https://www.towardshealthcare.com/schedule-meeting

Why did North America Dominate the Insulin Analog Market in 2024?

In 2024, North America captured the biggest revenue share of 34% in the market, due to growth in the incidence of diabetes. The presence of advanced healthcare infrastructure also increased the use of insulin analogs, where the presence of retail channels and reimbursement polices increases accessibility and affordability. The industries are also using advanced technologies to advance their innovation, which has contributed to the market growth.

What Made the Asia Pacific Grow Rapidly in the Insulin Analog Market in 2024?

Asia Pacific is expected to host the fastest-growing market during the forecast period, due to growing lifestyle changes, which are increasing the diabetes burden. The expanding healthcare is also increasing the adoption of advanced treatment options, driving the demand for insulin analogs. Additionally, the industries are also developing long-acting with rapid onset of action formulations, which is driving the market growth.

Segmental Insights

By molecule/action profile analysis

Why Did the Rapid-Acting Analog Segment Dominate in the Insulin Analog Market in 2024?

By molecule/action profile, the rapid-acting analogs segment led the market with a 30% share in 2024, due to their better postprandial control. Moreover, their dosing flexibility increased their use before and after the meals. Additionally, the risk of hypoglycaemia was also minimized, which increased their use.

By molecule/action profile, the long-acting analogs segment is expected to show the fastest growth rate during the upcoming years, as they reduce the dosing frequency. Additionally, the growing incidences of diabetes are also increasing their use, where their growing innovation are also increasing their use.

By dosage form/presentation analysis

Which Dosage Form/Presentation Type Segment Held the Dominating Share of the Insulin Analog Market in 2024?

By dosage form/presentation, the prefilled pens/pen cartridges segment held the dominating share of 45% share in the market in 2024, due to their easy use. They also provided accurate dosing, which enhanced the patient convenience and acceptance rates. Moreover, their portability also increased their use.

By dosage form/presentation, the vials (liquid) segment is expected to show the highest growth during the forthcoming years, as they offer flexible dose adjusting. Moreover, they are affordable, which is increasing their use. Additionally, different types of insulin biosimilars are also being developed, which is increasing their demand.

Get the latest insights on life science industry segmentation with our Annual Membership: https://www.towardshealthcare.com/get-an-annual-membership

By therapeutic indication/patient type analysis

What Made Type 1 Diabetes the Dominant Segment in the Insulin Analog Market in 2024?

By therapeutic indication/patient type, the type 1 diabetes segment led the market with a 35% share in 2024, due to the growth in early diagnosis. The insulin analogies provided a fast onset of action, which increased their use, as well as adherence to the treatment. Additionally, they were used for a longer duration, which increased their production.

By therapeutic indication/patient type, the type 2 diabetes segment is expected to show the fastest growth rate during the upcoming years, due to the rising incidence rates. Moreover, the growth in the overweight and lifestyle changes has also increased their incidence, which is increasing the demand for insulin analogues.

By end-user/customer analysis

How the Hospitals & Clinics Segment Dominated the Insulin Analog Market in 2024?

By end-user/customer, the hospitals & clinics segment held the largest share of 30% share in the market in 2024, due to growth in the patient volume. They provided early diagnosis, which increased the use of insulin analogs. They also offered patient monitoring and education, which increased their patient outcomes.

By end-user/customer, the retail pharmacies/community pharmacies segment is expected to show the highest growth during the predicted time, as they provide a wide range of insulin analogs. Moreover, their widespread availability also increased their use. Additionally, they also provide guidance, which increases the dependence on them.

By technology/formulation innovation analysis

Why Did the Standard Aqueous Formulations Segment Dominate in the Insulin Analog Market in 2024?

By technology/formulation innovation, the standard aqueous formulations segment held the largest share of 55% in the market in 2024, driven by their proven safety and efficacy. They were widely available and were compatible with existing delivery devices. Furthermore, their affordability also increased their use.

By technology/formulation innovation, the smart/connected delivery systems segment is expected to show the fastest growth rate during the predicted time, due to their improved dosing accuracy. This is increasing their use in the development of personalized treatment plans. They are also being used to support complex insulin regimens.

Browse More Insights of Towards Healthcare:

The global insulin API market size is calculated at US$ 4.51 billion in 2025, grew to US$ 4.94 billion in 2026, and is projected to reach around US$ 10.21 billion by 2034. The market is expanding at a CAGR of 9.52% between 2024 and 2034.

The insulin degludec market is on an upward trajectory, poised to generate substantial revenue growth, potentially climbing into the hundreds of millions over the forecast years from 2025 to 2034.

The insulin pens market size was valued at US$ 51.01 billion in 2025 and is projected to grow to 55.02 billion in 2026. Forecasts suggest it will reach approximately US$ 100.79 billion by 2034, registering a CAGR of 7.86% during the period.

The global insulin analog market size is estimated at US$ 16.99 billion in 2024, increased to US$ 17.68 billion in 2025, and is expected to reach around US$ 25.29 billion by 2034. The market is growing at a CAGR of 4.06% from 2025 to 2034.

The global insulin delivery system market size is calculated at US$ 17.77 in 2024, grew to US$ 19.18 billion in 2025, and is projected to reach around US$ 38.09 billion by 2034. The market is expanding at a CAGR of 7.92% between 2024 and 2034.

The global insulin drugs and delivery devices market size is calculated at USD 23.75 billion in 2024, grew to USD 25.58 billion in 2025, and is projected to reach around USD 49.18 billion by 2034. The market is expanding at a CAGR of 7.65% between 2025 and 2034.

The insulin pump market is forecast to grow at a CAGR of 9.65%, from USD 6.87 billion in 2024 to USD 17.25 billion by 2034, over the forecast period from 2025 to 2034.

The global smart insulin pens market size is calculated at USD 0.83 in 2024, grew to USD 0.92 billion in 2025, and is projected to reach around USD 2.42 billion by 2034. The market is expanding at a CAGR of 11.34% between 2025 and 2034.

The APAC insulin syringes market size is calculated at US$ 462.8 million in 2024, grew to US$ 491 million in 2025, and is projected to reach around US$ 848.6 million by 2034. The market is projected to expand at a CAGR of 6.1% between 2025 and 2034.

Recent Developments in the Insulin Analog Market

- In July 2025, Kirsty, an insulin analog used to improve glycemic control in adults and pediatric patients with diabetes mellitus developed by Biocon Biologics, was announced to have received U.S. FDA approval.

- In February 2025, Merilog, which is a rapid-acting human insulin analog used to reduce blood sugar level spikes during mealtime, was approved by the U.S. FDA

Insulin Analog Market Key Players List

- Novo Nordisk

- Sanofi,

- Eli Lilly and Company

- Biocon Limited

- Gan & Lee Pharmaceuticals

Segments Covered in The Report

By Molecule/Action Profile

- Rapid-acting Analogs

- Insulin Lispro

- Insulin Aspart

- Insulin Glulisine

- Short-acting/Regular Analogs

- Intermediate-acting Analogs

- Long-acting Analogs

- Insulin Glargine

- Insulin Detemir

- Insulin Degludec

- Ultra-long-acting Analogs

- Premixed/Combination Analogs

- Premix Rapid + Intermediate

- Fixed-ratio Basal + GLP-1 combinations

By Dosage Form/Presentation

- Prefilled Pens/Pen Cartridges

- Disposable Prefilled Pens

- Reusable Pens with Replaceable Cartridges

- Vials (Liquid)

- Cartridges for Insulin Pumps

- Insulin Pumps/Continuous Subcutaneous Insulin Infusion (CSII) Consumables

- Patch Pumps (Closed-loop compatible)

- Tubed Pumps

- Inhalable/Pulmonary Insulin Formulations

- Dry Powder Inhalers

- Nebulized Formulations

- Other (Disposable Pens, Auto-injectors, Novel delivery)

By Therapeutic Indication/Patient Type

- Type 1 Diabetes

- Basal-Bolus Regimens

- Pump Therapy (CSII)

- Type 2 Diabetes

- Basal-only Therapy

- Basal-plus/Premixed Regimens

- Gestational Diabetes

- Pediatric Use

- Inpatient/Hospital Use

By End-User/Customer Segment

- Hospitals & Clinics

- Inpatient Wards

- Outpatient Diabetes Clinics

- Retail Pharmacies/Community Pharmacies

- Chain Pharmacies

- Independent Pharmacies

- Home Care & Self-administration

- Home Pump Users

- Pen Users

- Long-term Care & Nursing Homes

- Specialty Clinics/Diabetes Centres

By Technology/Formulation Innovation

- Standard Aqueous Formulations

- Concentrated/High-strength Formulations (e.g., U-200, U-300)

- Ultra-stable/Room-temperature Stable Formulations

- Co-formulations (Insulin + GLP-1 agonist)

- Smart/Connected Delivery Systems

- Novel Excipient/Controlled-release Technologies

By Region

North America

- U.S.

- Canada

- Mexico

- Rest of North America

South America

- Brazil

- Argentina

- Rest of South America

Europe

-

Western Europe

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

- Eastern Europe

- Austria

- Russia & Belarus

- Türkiye

- Albania

- Rest of Eastern Europe

Asia Pacific

- China

- Taiwan

- India

- Japan

- Australia and New Zealand,

- ASEAN Countries (Singapore, Malaysia)

- South Korea

- Rest of APAC

MEA

- GCC Countries

- Saudi Arabia

- United Arab Emirates (UAE)

- Qatar

- Kuwait

- Oman

- Bahrain

- South Africa

- Egypt

- Rest of MEA

Immediate Delivery Available | Buy This Premium Research @ https://www.towardshealthcare.com/checkout/6396

Access our exclusive, data-rich dashboard dedicated to the healthcare market - built specifically for decision-makers, strategists, and industry leaders. The dashboard features comprehensive statistical data, segment-wise market breakdowns, regional performance shares, detailed company profiles, annual updates, and much more. From market sizing to competitive intelligence, this powerful tool is one-stop solution to your gateway.

Access the Dashboard: https://www.towardshealthcare.com/access-dashboard

About Us

Towards Healthcare is a leading global provider of technological solutions, clinical research services, and advanced analytics, with a strong emphasis on life science research. Dedicated to advancing innovation in the life sciences sector, we build strategic partnerships that generate actionable insights and transformative breakthroughs. As a global strategy consulting firm, we empower life science leaders to gain a competitive edge, drive research excellence, and accelerate sustainable growth.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Europe Region: +44 778 256 0738

North America Region: +1 8044 4193 44

APAC Region: +91 9356 9282 04

Web: https://www.towardshealthcare.com

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Automotive | Towards Food and Beverages | Towards Chemical and Materials | Towards Consumer Goods | Towards Dental | Towards EV Solutions | Nova One Advisor | Healthcare Webwire | Packaging Webwire | Automotive Webwire | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

Find us on social platforms: LinkedIn | Twitter | Instagram | Medium | Pinterest

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.